Inheritance Tax (IHT) can significantly erode the value of your estate, particularly for families with substantial property or investment portfolios. One increasingly popular solution is the use of family investment companies (FICs). When structured correctly, FICs provide control, flexibility, and the ability to mitigate IHT liabilities effectively.

Why Family Investment Companies Are Effective for IHT Planning

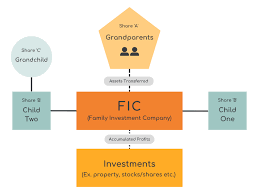

A family investment company is a private company created to hold investments, property, or other assets on behalf of a family. Unlike trusts, FICs allow the founders to retain control through shareholding structures while benefiting from potential tax efficiencies.

By transferring assets into a FIC, parents or grandparents can:

- Separate ownership from control

- Allocate shares to children or other beneficiaries

- Manage dividends and capital growth efficiently

These mechanisms can reduce the value of the taxable estate and limit exposure to inheritance tax.

Choosing the Right Share Structure

The key to minimising IHT through family investment companies lies in the share structure. Many investors opt for multiple share classes to differentiate between voting rights, income rights, and capital growth entitlement.

For example:

- Ordinary shares may provide voting control to the founders

- Preference shares can be allocated to children, giving them rights to income but not control

- Growth shares allow beneficiaries to benefit from capital appreciation

By carefully designing these structures, the value of the parents’ estate — the portion subject to IHT — can be reduced without losing control of the underlying assets.

Timing and Asset Transfers

Another important factor is timing. Transferring assets into a FIC too early or too late can affect IHT efficiency. HMRC may impose charges if transfers are made within seven years of death, depending on how the shares are gifted.

A professional advisor can help determine:

- When to transfer assets

- Which share classes to use

- How to allocate dividends strategically

This ensures that the family investment companies are optimised for both tax efficiency and long-term family control.

Managing Corporate Compliance

It’s also vital to maintain proper corporate governance. Even though FICs are often family-run, they are still subject to company law and HMRC reporting requirements. Failing to comply can jeopardise the tax advantages and lead to penalties.

Regular accounting, accurate dividend declarations, and proper record-keeping are essential. Using professional guidance ensures the family investment companies remain compliant while delivering the intended inheritance tax benefits.

Why Professional Advice Is Crucial

IHT planning through family investment companies is complex. Without careful planning, families risk losing potential reliefs or creating disputes over control and ownership. Consulting a specialist, such as UK Property Accountants, provides clarity on:

- Share structures

- Dividend allocation

- Tax planning strategies

- Succession planning

Don’t Miss Our Guide to: Gift with Reservation of Benefit

Conclusion

Structuring family investment companies effectively can offer significant advantages for inheritance tax planning. By carefully designing share classes, timing asset transfers, and ensuring compliance, families can protect wealth for future generations while retaining control over their assets.

For any UK family considering this approach, consulting expert guidance ensures that your FIC is both tax-efficient and compliant, maximising the long-term benefit of your investments.